Thungela Resources Limited (JSE:TGA) shareholders have seen the share price descend 21% over the month. But that doesn’t detract from the splendid returns of the last year. Like an eagle, the share price soared 217% in that time. So it may be that the share price is simply cooling off after a strong rise. More important, going forward, is how the business itself is going.

Although Thungela Resources has shed R8.1b from its market cap this week, let’s take a look at its longer term fundamental trends and see if they’ve driven returns.

Our analysis indicates that TGA is potentially undervalued!

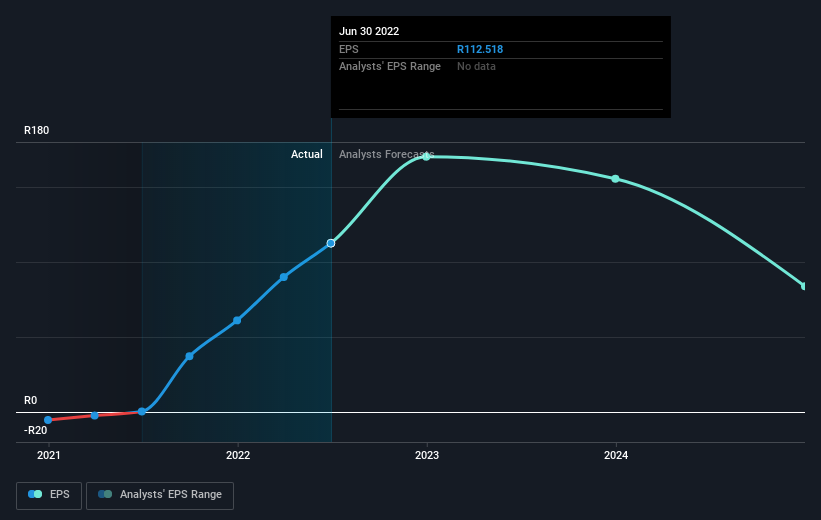

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Thungela Resources boasted truly magnificent EPS growth in the last year. We don’t think the exact number is a good guide to the sustainable growth rate, but we do think this sort of increase is impressive. So we’re unsurprised to see the share price gaining ground. Strong growth like this can be evidence of a fundamental inflection point in the business, making it a good time to investigate the stock more closely.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Thungela Resources has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Thungela Resources’ TSR for the last 1 year was 306%, which exceeds the share price return mentioned earlier. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It’s nice to see that Thungela Resources shareholders have gained 306% over the last year, including dividends. The more recent returns haven’t been as impressive as the longer term returns, coming in at just 11%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We’ve identified 4 warning signs with Thungela Resources (at least 1 which is significant) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.